Four Key Characteristics of the FX Market

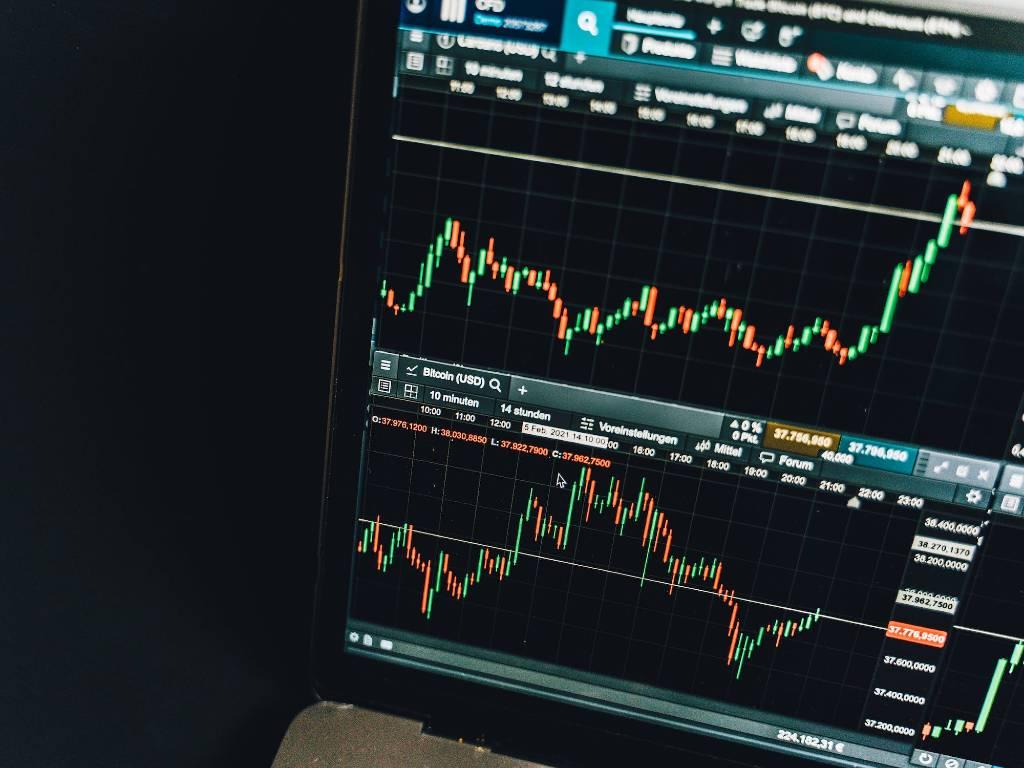

The foreign exchange market (also known as forex, FX, or the currencies market) is a global over-the-counter marketplace that determines currency exchange rates around the world. These markets enable participants to buy, sell, exchange, and speculate on the relative exchange rates of various currency pairs. Banks, forex dealers, investment management firms, hedge funds, retail forex dealers, and investors make up the foreign exchange markets, and they all keep a close eye on tradingview for developments.

This market is open 24 hours a day, from 5:00 p.m. EST on Sunday to 4:00 p.m. EST on Friday. It is the world’s most liquid financial market. Currency trading in the foreign exchange market is always done in pairs, so the value of one currency in that pair is relative to the value of the other currencies in that pair. There are two levels to the global market. The first is the interbank market, and the second is the over-the-counter market. The interbank market is where larger banks trade and exchange currency. The over-the-counter market, where individuals and businesses trade, has grown in popularity. So, with this in mind, we thought we would look at the characteristics of the FX market to find out what makes it so successful.

Liquidity

The most popular FX instrument in the world, accounting for more than one-third of total activity, is currency spot trading. The volume of spot FX trading is estimated to be around $1.5 trillion daily, making it the world’s largest and most liquid market. Compared to futures at $437.4 billion and equities at $191 billion, foreign exchange liquidity dwarfs all other markets. Trading currencies account for 80% of all daily transactions.

Transparency

The foreign exchange market has a high level of information efficiency. Transactions on the market are recorded electronically, and information is updated quickly across the market, making it both efficient and transparent. The market is too large and dispersed to be manipulated by a single person or group. Also, transactions cannot be hidden, which is another feature that market participants consider essential. When there is information asymmetry or inefficiency in markets, it creates winners and losers based on market movements. A transparent market means that all known information from the past and present is displayed in prices, and there are no opportunities for other participants to manipulate prices.

Availability

Except for weekends, the foreign exchange market is the only market that is open 24 hours a day. This is possible because all continents participate in trading. This novel concept enables dealers to act without regard for time and respond to any development that occurs anywhere on the planet.

A cycle occurs throughout the day, with busy periods followed by relatively quiet spells. Business is most intense when two or more markets are active simultaneously, such as Asia and Europe, or Europe and America. Given the erratic flow of business around the clock, market participants may react less aggressively to an exchange rate development that occurs during a relatively quiet time of day, preferring to wait and see if the development is confirmed when the major markets open. Nonetheless, the 24-hour market provides a continuous real-time market assessment of currency values.

Unique

The forex market is also distinct from most other financial markets because it is sensitive to macro and microeconomic events. In contrast, individual equities and equity markets move primarily in response to domestic events in specific countries, or to data and reports issued by respective companies or business sectors. The factors influencing currency value movement are thus unique when compared with other markets, making it critical for retail forex traders to keep on top of unfolding economic events via an up-to-date economic calendar.

Conclusion

Factors influencing the foreign exchange market are inextricably linked to either demand or supply in the market. Interest rates, economic stability, future expectations, and rate of return are examples. Therefore, to better understand how these factors can affect the foreign exchange market, you must first understand the market shifts in demand and supply.